Due diligence is certainly not the most exciting part of a business. In fact , this might be the tedious part. However , you have to take on this task with the utmost importance to protect your customers.

The reason we are all doing this?

- confirm the value of the transaction

- check assurances and guarantees

- determine whether the necessary approvals or applications have been received

To confirm the value of the transaction, lawyers ensure that you will find no hidden commitments. Intellectual property or home (IP) is also checked to ensure that all IP addresses remain protected through the entire transaction and that the IP value can be not lost. It should be noted that the role of a lawyer in business is to never determine the value, but only to what is elements that have been identified as creating value.

In order to review the warranties and guarantees and determine whether consent or application is necessary, lawyers must carefully review the parties’ corporate documents, contracts, lets, and regulatory approvals. Based on a review of these and similar documents, legal professionals can determine whether the transaction can proceed as planned or if additional assurances and warranties or perhaps exclusions from existing assurances and warranties are required. Lawyers can also decide whether additional agreements such as charité or consent are required.

The solicitor’s role in the due diligence review should be to preview the documents that the customer intends to disclose, review the files created by other parties, and ensure that a due diligence review is performed and so nothing is in steps into the background. To be able to start the process with the right foot, legal professionals need to create a due diligence checklist that lists all the items that each party should produce.

Mergers and acquisitions are part of everyday life inside the trade fair business. However, purchases are risky. Many do not match expectations because they can increase product sales but do not create synergies. They add to the size, but not necessarily to the top quality. The strategic focus on the aim is the key to successful mergers.

Evaluating these transactions is known as a complex task that requires not only the understanding of industry experts, but also trustful relationships to confidentially influence the results. Due Diligence provides actionable thoughts that you can trust and gives you a comprehension of how that Target is positioned in a industrial environment.

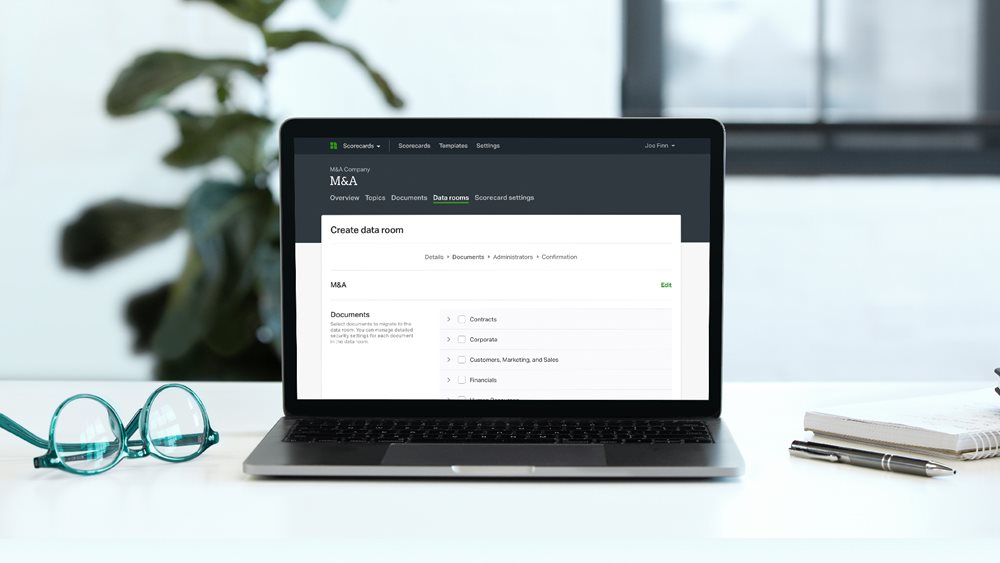

When correctly validated, it is inexpensive to use state-of-the-art m&a data room that is simple to implement and maintain.

Contemporary dataroom focuses on data security, i actually. e. they integrate complex security measures, including advanced encryption equally during transmission and in the nonproductive state, as well as multi-level authentication steps as well as access and callback types of procedures in a separate best virtual data room.

In addition to these system levels, in addition there are document-specific security features, including watermarks, disabled printing, and blind display. Although security is one of the most important facets of all (both traditional and modern), modern data room differs from its traditional counterparts in many additional very important points.